Flood insurance safeguards homeowners against the financial repercussions of flood damage, which can be substantial. Homeowners in areas prone to flooding should consider purchasing flood insurance to protect their investment. Several insurance companies offer flood insurance, but not all companies are created equal. It’s essential for homeowners to research and compare different insurance providers to find the best coverage for their needs.

When shopping for flood insurance, homeowners should consider the following factors:

- The company’s financial stability

- The company’s claims-paying history

- The policy’s coverage limits

- The policy’s deductibles

- The policy’s premiums

Homeowners can use a variety of resources to research and compare flood insurance companies. The National Flood Insurance Program (NFIP) maintains a list of participating insurance companies. Homeowners can also contact their state insurance commissioner’s office for more information. By taking the time to research and compare different insurance providers, homeowners can find the best flood insurance coverage for their needs.

Top-rated insurance companies for homeowners in flood-prone areas

When it comes to flood insurance, not all companies are created equal. Homeowners in flood-prone areas should consider the following five key aspects when choosing an insurance provider:

- Financial stability: The company should have a strong financial history and be able to pay claims in a timely manner.

- Claims-paying history: The company should have a good reputation for paying claims fairly and quickly.

- Coverage limits: The company should offer coverage limits that are high enough to protect the homeowner’s investment.

- Deductibles: The company should offer deductibles that are affordable for the homeowner.

- Premiums: The company should offer premiums that are competitive with other insurance providers.

By considering these five key aspects, homeowners in flood-prone areas can choose an insurance provider that will provide the best coverage for their needs.

Financial stability

Financial stability is one of the most important factors to consider when choosing a flood insurance company. A financially stable company will be able to pay claims in a timely manner, even after a major flood event. This is important because flood damage can be extensive and expensive, and homeowners need to be able to count on their insurance company to help them recover.

There are a number of ways to assess a company’s financial stability. One way is to look at its financial ratings. Financial ratings agencies such as AM Best and Standard & Poor’s evaluate insurance companies based on their financial strength and claims-paying ability. A company with a high financial rating is more likely to be able to pay claims in a timely manner.

Another way to assess a company’s financial stability is to look at its claims-paying history. A company with a good claims-paying history is more likely to be able to pay claims in a timely manner. Homeowners can contact their state insurance commissioner’s office to obtain information about a company’s claims-paying history.

Choosing a flood insurance company with a strong financial history is important for homeowners in flood-prone areas. A financially stable company will be able to pay claims in a timely manner, which will help homeowners recover from flood damage.

Claims-paying history

A good claims-paying history is an important indicator of a top-rated insurance company. When homeowners file a claim, they want to be sure that their insurance company will pay the claim fairly and quickly. A company with a good claims-paying history is more likely to do so.

There are a number of factors that can affect a company’s claims-paying history. These factors include the company’s financial stability, its claims-handling process, and its customer service. A financially stable company is more likely to be able to pay claims quickly. A company with a good claims-handling process is more likely to process claims efficiently and fairly. And a company with good customer service is more likely to be responsive to customer inquiries and concerns.

Homeowners can assess a company’s claims-paying history by looking at its customer reviews and by contacting their state insurance commissioner’s office. Customer reviews can provide valuable insights into a company’s claims-handling process and customer service. And the state insurance commissioner’s office can provide information about a company’s claims-paying history and any complaints that have been filed against the company.

Choosing a flood insurance company with a good claims-paying history is important for homeowners in flood-prone areas. A company with a good claims-paying history is more likely to pay claims fairly and quickly, which will help homeowners recover from flood damage.

Coverage limits

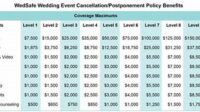

When it comes to flood insurance, coverage limits are of paramount importance for homeowners in flood-prone areas. Top-rated insurance companies understand this and offer coverage limits that are high enough to protect the homeowner’s investment. This ensures that homeowners can recover from flood damage without having to worry about financial ruin.

- Replacement cost coverage: This type of coverage pays to replace the homeowner’s damaged property with new property of like kind and quality. It is the most comprehensive type of flood insurance coverage available and is highly recommended for homeowners in flood-prone areas.

- Actual cash value coverage: This type of coverage pays to replace the homeowner’s damaged property with property of like kind and quality, minus depreciation. It is less comprehensive than replacement cost coverage, but it is also less expensive.

- Guaranteed replacement cost coverage: This type of coverage pays to replace the homeowner’s damaged property with new property of like kind and quality, regardless of the cost. It is the most expensive type of flood insurance coverage available, but it also provides the most protection.

When choosing a flood insurance policy, it is important to select coverage limits that are high enough to protect the homeowner’s investment. Top-rated insurance companies offer a variety of coverage limits to choose from, so homeowners can find a policy that meets their specific needs.

Deductibles

Deductibles play a crucial role in flood insurance policies. They represent the amount of money that the homeowner is responsible for paying out-of-pocket before the insurance company begins to cover the costs of flood damage. Top-rated insurance companies for homeowners in flood-prone areas understand the financial burden that flood damage can impose and offer deductibles that are affordable for the homeowner.

There are several reasons why affordable deductibles are important for homeowners in flood-prone areas. First, flood damage can be extensive and expensive. The cost of repairing or replacing a flooded home can easily exceed tens of thousands of dollars. A high deductible can make it difficult for homeowners to afford the repairs and can lead to financial hardship.

Second, flood damage can occur at any time. Floods can be caused by heavy rains, snowmelt, or dam failures. They can happen during any season and can affect any area. Homeowners in flood-prone areas need to be prepared for the possibility of flooding and should have an affordable flood insurance policy in place.

Top-rated insurance companies offer a range of deductibles to choose from, so homeowners can find a policy that meets their specific needs and budget. By choosing an affordable deductible, homeowners can protect themselves from the financial burden of flood damage and ensure that they can recover from a flood event.

Premiums

When it comes to flood insurance, premiums are a major consideration for homeowners. Top-rated insurance companies understand this and offer premiums that are competitive with other insurance providers. This ensures that homeowners can get the coverage they need without breaking the bank.

There are several reasons why competitive premiums are important for homeowners in flood-prone areas. First, flood insurance is essential for protecting homeowners from the financial devastation that can result from flood damage. Without flood insurance, homeowners could be responsible for paying for repairs or replacing their home and belongings out of pocket. This could lead to financial ruin.

Second, flood insurance is becoming increasingly important as the climate changes. The National Oceanic and Atmospheric Administration (NOAA) reports that the number of flood-related disasters has increased significantly in recent years. This trend is expected to continue as the climate changes and sea levels rise.

As a result, it is more important than ever for homeowners in flood-prone areas to have affordable flood insurance. Top-rated insurance companies offer competitive premiums that make flood insurance affordable for homeowners.

By choosing a top-rated insurance company, homeowners can get the coverage they need at a price they can afford. This peace of mind is invaluable for homeowners in flood-prone areas.

Tips from Top-rated insurance companies for homeowners in flood-prone areas

Homeowners in flood-prone areas should take steps to protect their homes and belongings from flood damage. Here are five tips from top-rated insurance companies:

Tip 1: Purchase flood insurance. Flood insurance is the only way to protect your home and belongings from flood damage. Homeowners insurance policies do not cover flood damage.Tip 2: Elevate your home. Elevating your home is one of the most effective ways to protect it from flood damage. If your home is in a flood-prone area, you should consider elevating it above the base flood elevation.Tip 3: Install flood vents. Flood vents allow water to enter your home during a flood, which can help to reduce the pressure on your home and prevent it from collapsing.Tip 4: Protect your belongings. Move your belongings to higher ground before a flood is expected. If you have time, you can also place your belongings in waterproof containers.Tip 5: Have an evacuation plan. In the event of a flood, you may need to evacuate your home. Have an evacuation plan in place so that you know where to go and what to do.By following these tips, homeowners in flood-prone areas can help to protect their homes and belongings from flood damage.

Summary of key takeaways or benefits:

- Flood insurance is the only way to protect your home and belongings from flood damage.

- Elevating your home, installing flood vents, and protecting your belongings can help to reduce the risk of flood damage.

- Having an evacuation plan in place will help you to stay safe in the event of a flood.

Transition to the article’s conclusion:

By following these tips, homeowners in flood-prone areas can take steps to protect their homes and belongings from flood damage. Flood insurance is the most important step, but elevating your home, installing flood vents, and protecting your belongings can also help to reduce the risk of damage.