Car insurance premiums can vary significantly, particularly for drivers under the age of 25. Several factors are considered when determining these rates, including driving experience, claims history, and the specific vehicle being insured.

One of the most influential factors affecting insurance rates for young drivers is their relative lack of driving experience. Insurers perceive inexperienced drivers as having a higher risk of accidents, leading to higher premiums. Additionally, young drivers are more likely to engage in risky behaviors, such as speeding and driving under the influence of alcohol, which further increases their risk profile.

Despite these factors, comparing car insurance rates is essential for young drivers who want to find the most affordable coverage. By comparing quotes from different insurers, young drivers can potentially save money on their premiums while still obtaining the necessary protection.

When comparing car insurance rates, it’s crucial to consider not only the premium amount but also the coverage provided by the policy. Young drivers should look for policies that offer adequate liability coverage in case of an accident, as well as collision and comprehensive coverage to protect their vehicle.

By understanding the factors that influence their insurance rates and taking steps to compare quotes, young drivers can make informed decisions about their car insurance coverage and find the best possible rates.

Compare Car Insurance Rates for Young Drivers Under 25

Car insurance rates for young drivers can vary considerably. Comparing rates from different insurers is crucial to secure the most suitable and affordable coverage. Here are five key aspects to consider when comparing car insurance rates for young drivers under 25:

- Age: Insurers consider younger drivers as higher risk due to less experience, leading to potentially higher premiums.

- Driving history: A clean driving record with no accidents or violations can significantly lower insurance rates.

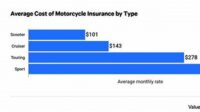

- Vehicle type: Insuring a high-performance or expensive car typically attracts higher premiums compared to insuring a modest or used car.

- Coverage level: Choosing higher coverage limits and additional endorsements can increase insurance costs.

- Location: Insurance rates can vary based on factors like crime rates and traffic congestion in the area where the car is primarily driven.

By carefully considering these key aspects and comparing quotes from multiple insurers, young drivers can make informed decisions about their car insurance coverage and find the most affordable rates that meet their specific needs and budget.

Age

Understanding this connection is essential for young drivers seeking affordable car insurance. By acknowledging the impact of age on insurance rates, young drivers can proactively explore strategies to mitigate the financial burden. This may include taking defensive driving courses to improve their driving skills and demonstrate responsibility to insurers, potentially leading to lower premiums.

Comparing car insurance rates for young drivers under 25 is crucial, considering the potential impact of age on premiums. By comparing quotes from multiple insurance providers, young drivers can identify the most competitive rates while ensuring adequate coverage for their needs.

Driving history

- Reduced Risk Profile: A clean driving record demonstrates a lower likelihood of future accidents, reducing the perceived risk for insurance companies. This translates into lower premiums, as insurers are more confident in the driver’s ability to operate a vehicle safely.

- Financial Responsibility: A clean driving history indicates financial responsibility and maturity, qualities that insurance companies value. Drivers with a clean record are less likely to file claims, further reducing the risk for insurers and potentially leading to lower premiums.

- Safe Driving Practices: A clean driving history suggests that the driver adheres to safe driving practices, such as obeying traffic laws, avoiding distractions, and maintaining a safe following distance. These practices reduce the likelihood of accidents and subsequent claims, resulting in lower insurance rates.

- Insurance Discounts: Many insurance companies offer discounts for drivers with clean driving records. These discounts can range from 5% to 20% or more, providing substantial savings on insurance premiums.

For young drivers under 25, maintaining a clean driving record is paramount in securing affordable car insurance rates. By demonstrating responsible driving habits and avoiding accidents and violations, young drivers can significantly lower their insurance costs and enjoy the peace of mind that comes with knowing they are financially protected on the road.

Vehicle type

- Increased Risk: High-performance cars are often associated with aggressive driving and a higher likelihood of accidents. Insurers perceive these vehicles as posing a greater risk, leading to higher premiums.

- Replacement Cost: Expensive cars cost more to replace in the event of an accident, which is reflected in higher insurance premiums. Insurers must factor in the potential cost of a total loss when determining coverage costs.

- Repair Costs: High-performance cars often require specialized parts and labor for repairs, which can be more expensive than repairs for modest or used cars. Insurers consider these potential repair costs when setting premiums.

- Safety Features: Modest or used cars may have fewer advanced safety features than high-performance cars, which can increase the risk of accidents and subsequent insurance claims.

For young drivers under 25, who are already considered higher risk drivers, insuring a high-performance or expensive car can result in significantly higher insurance premiums. Therefore, it is crucial for young drivers to consider the type of vehicle they choose when comparing car insurance rates, as their choice can have a substantial impact on the cost of coverage.

Coverage Level

- Liability Coverage: Liability coverage protects drivers from financial responsibility for injuries or property damage caused to others in an accident. Higher liability limits provide greater protection but increase premiums.

- Collision and Comprehensive Coverage: Collision coverage pays for repairs to the insured vehicle in an accident, while comprehensive coverage covers non-collision events like theft or vandalism. Higher coverage limits and lower deductibles result in higher premiums.

- Endorsements: Endorsements are optional add-ons to an insurance policy that provide additional coverage, such as rental car reimbursement or roadside assistance. Each endorsement typically increases the premium.

For young drivers under 25, who are already facing higher insurance rates, choosing higher coverage limits and additional endorsements can significantly increase their insurance costs. It’s important to carefully consider the level of coverage needed and weigh the costs and benefits before making a decision.

Location

For example, young drivers living in urban areas with high crime rates and traffic congestion may face higher insurance premiums compared to those living in rural areas with lower crime rates and less traffic. This is because insurers perceive vehicles driven in high-risk areas as more likely to be involved in accidents, stolen, or vandalized. Additionally, traffic congestion can increase the likelihood of fender benders and other minor accidents, which can also lead to higher insurance rates.

Understanding the impact of location on insurance rates is crucial for young drivers under 25. By considering the location where the car will be primarily driven, they can better anticipate the potential cost of insurance and make informed decisions when comparing quotes from different insurance providers.

In conclusion, location is an important factor to consider when comparing car insurance rates for young drivers under 25. By understanding the connection between location and insurance costs, young drivers can make informed decisions about their coverage and find the most affordable rates.

Tips for Comparing Car Insurance Rates for Young Drivers Under 25

Comparing car insurance rates is crucial for young drivers under 25 to secure affordable coverage. Here are some assertive tips to help you navigate the process effectively:

Tip 1: Start Comparing Early: Begin researching and comparing car insurance rates as soon as possible. This provides ample time to gather quotes and find the best deals.

Tip 2: Maintain a Clean Driving Record: A clean driving history with no accidents or violations can significantly lower insurance premiums. Practice safe driving habits and avoid distractions to keep your record clean.

Tip 3: Choose a Vehicle Wisely: High-performance or expensive cars typically attract higher insurance rates. Consider opting for a modest or used car to save on insurance costs.

Tip 4: Consider Your Coverage Needs: Determine the appropriate coverage levels based on your individual needs and budget. Higher coverage limits and additional endorsements may increase premiums.

Tip 5: Explore Discounts: Many insurance companies offer discounts for young drivers, such as good student discounts, defensive driving course completion discounts, and multi-car discounts. Inquire about these discounts to lower your premiums.

Tip 6: Compare Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Compare rates from different insurance providers to find the most competitive coverage at the best price.

Tip 7: Read the Policy Carefully: Before finalizing your choice, thoroughly read and understand the terms and conditions of the insurance policy to ensure it meets your coverage needs.

Tip 8: Consider Usage-Based Insurance: Usage-based insurance programs track driving behavior and reward safe drivers with lower premiums. Explore this option if you are a responsible driver.

By following these tips, young drivers under 25 can effectively compare car insurance rates and secure affordable coverage that meets their specific needs and budget.