Planning a destination wedding is exciting, but it also comes with unique risks and considerations. Wedding insurance coverage for destination weddings provides peace of mind and financial protection in case of unexpected events that can disrupt or ruin your special day.

Destination wedding insurance typically covers a range of potential mishaps, including:

- Trip cancellation or interruption due to weather, illness, or other unforeseen circumstances

- Lost or damaged luggage or personal belongings

- Medical emergencies or accidents

- Vendor cancellations or no-shows

- Liability coverage in case of accidents or injuries

The cost of wedding insurance for destination weddings varies depending on the level of coverage you choose and the specific details of your wedding. However, it is generally a small investment that can provide significant financial protection in case of unexpected events.

If you are planning a destination wedding, it is important to consider purchasing wedding insurance coverage to protect your investment and ensure that your special day goes smoothly.

Wedding insurance coverage for destination weddings

Planning a destination wedding is an exciting yet complex endeavor, and having the right insurance coverage is crucial for safeguarding your special day. Wedding insurance coverage for destination weddings provides comprehensive protection against unforeseen circumstances that can disrupt or ruin your special event. Here are six key aspects to consider:

- Coverage: Destination wedding insurance policies typically cover trip cancellation or interruption, lost or damaged luggage, medical emergencies, vendor cancellations, and liability.

- Customization: Policies can be customized to meet the specific needs and budget of each couple, allowing for tailored protection.

- Peace of mind: Knowing that you have financial protection in case of unexpected events can provide peace of mind and allow you to fully enjoy your wedding.

- Vendor issues: Destination weddings rely heavily on vendors, and insurance coverage can protect you if a vendor cancels or fails to deliver.

- Medical emergencies: Destination weddings often involve travel to unfamiliar locations, making medical emergencies more likely. Insurance can cover medical expenses and transportation costs. li>

Legal liability: Accidents or injuries can occur during destination weddings, and insurance provides liability coverage to protect you from financial responsibility.

In conclusion, wedding insurance coverage for destination weddings is an essential investment that provides peace of mind and financial protection. By carefully considering the key aspects outlined above, couples can ensure that their special day is protected against unforeseen circumstances and that they can fully enjoy their celebration without worry.

Coverage

Wedding insurance coverage for destination weddings is essential for protecting couples against unforeseen circumstances that can disrupt or ruin their special day. The coverage provided by destination wedding insurance policies is comprehensive, encompassing a range of potential mishaps that could otherwise lead to significant financial losses or stress.

Consider the following scenarios:

- If a couple’s flights are canceled due to a hurricane, their trip cancellation coverage would reimburse them for non-refundable expenses such as flights, accommodation, and excursions.

- In the event of lost or damaged luggage, couples can file a claim to recover the value of their belongings.

- If a medical emergency occurs during the wedding, insurance coverage can help pay for medical expenses and transportation costs.

- If a vendor cancels or fails to deliver, couples can seek compensation from their insurance policy to cover the costs of replacing the vendor.

- Liability coverage protects couples from financial responsibility in case of accidents or injuries that occur during the wedding.

By providing coverage for these potential risks, destination wedding insurance gives couples peace of mind and allows them to fully enjoy their special day without worrying about the financial consequences of unforeseen events.

Customization

Customization is a key feature of wedding insurance coverage for destination weddings, enabling couples to tailor their policies to meet their unique requirements and budget. This flexibility is essential given the diverse nature of destination weddings and the varying needs of each couple.

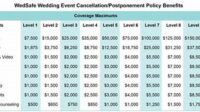

- Coverage Levels: Couples can choose the level of coverage they need, from basic plans that cover essential risks to comprehensive plans that provide maximum protection.

- Activity-Specific Coverage: Policies can be customized to include coverage for specific activities or excursions planned during the wedding, such as scuba diving, hiking, or hot air ballooning.

- Destination-Specific Considerations: Coverage can be tailored to the specific destination of the wedding, taking into account factors such as weather patterns, political stability, and healthcare availability.

- Budget Constraints: Couples can adjust their coverage levels and deductibles to fit their budget, ensuring that they have adequate protection without overspending.

By allowing for customization, wedding insurance coverage for destination weddings empowers couples to create a policy that is tailored to their specific needs and provides peace of mind without breaking the bank.

Peace of mind

When planning a destination wedding, there are countless details to consider and potential pitfalls to navigate. From unpredictable weather conditions to vendor issues, unexpected events can arise at any moment, threatening to disrupt or even ruin your special day. Wedding insurance coverage for destination weddings provides a crucial safety net against these unforeseen circumstances, giving you peace of mind and allowing you to fully enjoy your celebration.

The peace of mind that comes with wedding insurance coverage cannot be overstated. Imagine the relief of knowing that if your flights are canceled due to a hurricane, your non-refundable expenses will be reimbursed. Or the comfort of knowing that if a vendor cancels or fails to deliver, you will be financially protected. With wedding insurance, you can relax and focus on creating memories without the added stress of worrying about potential financial losses.

In the context of destination weddings, peace of mind is particularly important. Destination weddings often involve significant financial investments and complex logistics, making them more vulnerable to unexpected events. Wedding insurance coverage provides a buffer against these risks, ensuring that your special day is protected and that you can fully enjoy the experience without financial worries.

In summary, the peace of mind provided by wedding insurance coverage for destination weddings is an invaluable component of your overall wedding planning strategy. It allows you to relax, focus on your celebration, and create memories that will last a lifetime.

Vendor issues

Vendor issues are a common concern for all weddings, but they can be particularly disruptive and costly in the context of destination weddings. Destination weddings often involve hiring vendors from a different location, which can increase the risk of communication problems, misunderstandings, and even fraud. Wedding insurance coverage for destination weddings provides crucial protection against vendor issues, ensuring that you are financially protected if a vendor cancels or fails to deliver on their contractual obligations.

Consider the following real-life example: A couple planning a destination wedding in Mexico hired a local photographer. However, a few weeks before the wedding, the photographer canceled due to a family emergency. The couple was left scrambling to find a replacement photographer at the last minute, and they ended up paying a significantly higher price. Fortunately, they had purchased wedding insurance, which covered the additional costs.

Wedding insurance coverage for destination weddings can also protect you from financial losses if a vendor fails to deliver on their promised services. For example, if you hire a florist to create your wedding bouquets and centerpieces, and they fail to deliver the flowers on time or in the agreed-upon style, your insurance policy can help you recover the costs of replacing the flowers or hiring a new florist.

In summary, vendor issues are a significant risk for destination weddings, and wedding insurance coverage can provide valuable protection against financial losses. By ensuring that you have adequate insurance coverage, you can minimize the impact of vendor issues and protect your investment in your special day.

Medical emergencies

When planning a destination wedding, it is essential to consider the potential for medical emergencies, especially if you are traveling to an unfamiliar location. Wedding insurance coverage for destination weddings can provide peace of mind and financial protection in case of unexpected medical events.

- Increased Risk of Medical Emergencies: Destination weddings often involve travel to exotic or remote locations, which may lack adequate medical facilities and resources. This increased risk of medical emergencies makes it crucial to have adequate insurance coverage.

- Coverage for Medical Expenses: Wedding insurance policies typically cover medical expenses incurred during the wedding, including hospitalization, doctor visits, and medication costs. This coverage can help alleviate the financial burden of unexpected medical situations.

- Transportation Costs: In the event of a medical emergency, transportation costs can quickly add up, especially if you need to be evacuated to a different location for treatment. Wedding insurance coverage can help cover these expenses, ensuring that you receive the necessary medical care without worrying about the financial implications.

- Peace of Mind: Knowing that you have medical insurance coverage for your destination wedding can provide peace of mind, allowing you to fully enjoy your special day without the added stress of worrying about potential medical expenses.

In summary, medical emergencies are a potential risk for destination weddings, and wedding insurance coverage can provide valuable protection against the financial consequences of unexpected medical events. By ensuring that you have adequate insurance coverage, you can minimize the impact of medical emergencies and protect your investment in your special day.

Tips for Choosing Wedding Insurance Coverage for Destination Weddings

Planning a destination wedding is an exciting endeavor, but it also comes with unique considerations, including the need for specialized insurance coverage. Here are some tips to help you choose the right wedding insurance policy for your destination wedding:

Tip 1: Determine Your Coverage Needs

Assess the specific risks associated with your destination wedding, such as weather-related events, vendor cancellations, and medical emergencies. Tailor your insurance policy to cover these potential risks and provide adequate financial protection.

Tip 2: Choose a Reputable Insurance Provider

Research and compare different insurance providers to find one with a strong track record and positive customer reviews. Ensure they have experience in providing coverage for destination weddings.

Tip 3: Read the Policy Carefully

Before purchasing an insurance policy, thoroughly review the terms and conditions. Pay attention to the coverage limits, exclusions, and deductibles to ensure the policy meets your specific needs.

Tip 4: Consider Additional Coverage Options

In addition to basic coverage, consider purchasing additional options such as “cancel for any reason” coverage, which provides flexibility in case of unforeseen circumstances. Explore other add-ons that align with your unique needs.

Tip 5: Purchase Coverage Early

Secure your wedding insurance coverage as early as possible to ensure you have adequate time to review the policy and make any necessary adjustments. Early purchase also allows you to take advantage of any discounts or promotions.

Summary:

By following these tips, you can choose the right wedding insurance coverage for your destination wedding. Remember to assess your coverage needs, choose a reputable provider, read the policy carefully, consider additional coverage options, and purchase coverage early. With proper insurance protection, you can enjoy your special day with peace of mind, knowing that you are financially protected against unexpected events.

Transition to the article’s conclusion:

Wedding insurance coverage for destination weddings is an essential investment that provides a safety net against potential risks and unforeseen circumstances. By following these tips, you can make an informed decision about your insurance coverage and ensure that your special day is protected.